Financial Company Connects Marijuana Businesses With Banking, Financial Services

Businesses that operate in the marijuana industry face many challenges, but none is greater than the fact that they are denied banking services by most financial institutions.

Why? Because marijuana remains illegal at the federal level. Banks fear that by doing business with a dispensary or other marijuana-related business, they run the risk of having federal regulators crack down on them, a situation all banks want to avoid.

That has left many marijuana businesses operating in a cash-only situation. However, Dama Financial is filling that gap and supporting marijuana businesses with financial services. Their approach: Dama Financial, through its bank partners, partners with financial institutions to bridge the gap between banks and the cannabis industry.

The Banking Problem in Marijuana

The extent of the issue for marijuana businesses is hard to exaggerate. Without access to banking services – this includes the services of companies such as Visa and Mastercard – businesses face increased security issues.

They also are having trouble getting financed to expand services in reaction to “double-digit growth,” according to CNBC. Against this backdrop, Dama Financial has emerged as the leader in connecting the cannabis industry with financial services.

What Dama Financial Offers

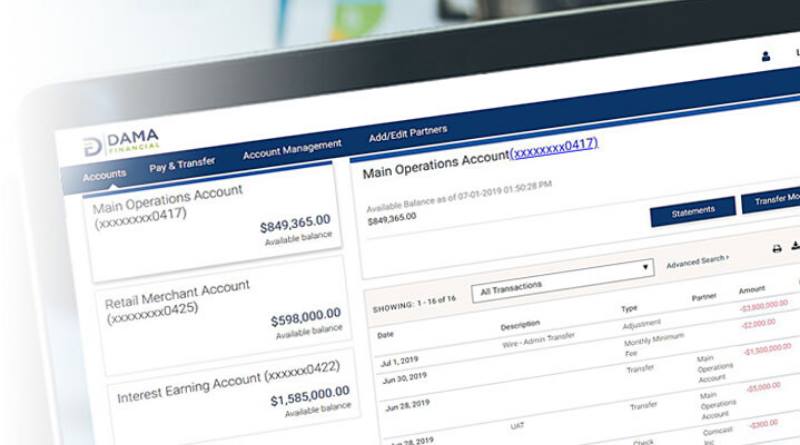

Dama Financial presents itself as “truly the first compliant banking option.” By partnering with banks and financial institutions that are FDIC insured, they can assure marijuana-related businesses that their money is also FDIC insured.

That’s a big deal to businesses. No other legal business is forced to work only in cash and without the safety of having their money insured by the FDIC in the event their bank fails.

All the services offered through Dama are compliant with state regulations.

As Dama Financial puts it on their webpage: “Secure your cash, make and receive payments electronically or by check — and stop worrying your account will be shut down because you are a cannabis-related business.”

Other Dama Financial Services

Dama provides other financial services through its partner banks. Again, this is the type of service businesses in any other industry have come to expect. For those in the cannabis industry, this is welcome news.

Dama provides other financial services through its partner banks. Again, this is the type of service businesses in any other industry have come to expect. For those in the cannabis industry, this is welcome news.

The services include the following.

- Premier Business Account. This account allows businesses to pay vendors, taxes, utilities, and employees by ACH, wire or check. It also features armored courier cash pickup and deposit, a dedicated Private Banker and a secondary 1% interest-earning account.

- Cash to Tax Account. This includes armored courier cash pick up and deposit into an account that businesses can use to pay taxes online with no required minimum balance.

- Paytender. This cashless payment system allows retailers to accept electronic payments for purchases online, in-store or via delivery. Paytender can integrate with a common point of sale system or with a Paytender terminal.

The banks and other providers that Dama partners with also can offer accounting, tax, payroll, human resources support and insurance services.

Dama Financial was founded by veterans of the banking and payments industry who are “driven by their passion for innovation, solving complex business problems and driving business value for all stakeholders.” For those in the marijuana business, they are offering something that can fundamentally change how they conduct business.